Introduction

As the UK automotive landscape continues to evolve, older drivers are facing significant changes when it comes to car tax. While many might have become accustomed to the existing system, the upcoming reforms promise to shake things up. These changes could impact your finances, especially if you’re an older driver with a vehicle that doesn’t meet new environmental standards. So, how does this specifically impact you? How will these changes affect your daily commute, or even your car’s affordability? Let’s dive in and explore everything you need to know about the upcoming car tax changes for older drivers.

What are the key Older Drivers Car Tax Changes?

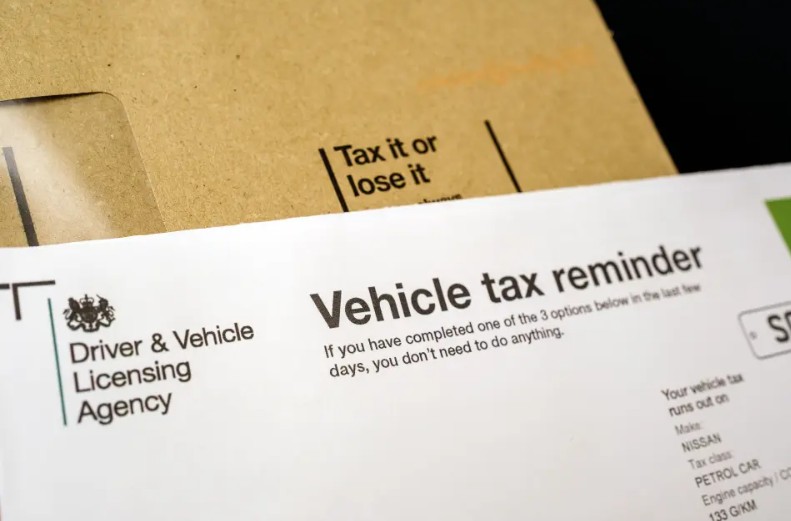

Car tax, or Vehicle Excise Duty (VED), is set to undergo some important changes that directly affect older drivers. Let’s break down these changes:

1. How Will the New Car Tax System Affect Older Vehicles?

- Environmental Considerations: The UK government is increasingly focused on reducing carbon emissions. As such, older cars—especially those that rely on petrol or diesel—could face higher tax rates.

- Emissions-based Pricing: Cars that emit more CO2 will be subject to higher VED rates. This means older vehicles with higher emissions will likely see a rise in their tax bills.

- Electric and Hybrid Cars: On the other hand, electric and hybrid vehicles are expected to benefit from tax incentives, encouraging older drivers to consider switching to greener alternatives.

2. How Much Will Older Drivers Be Affected by These Changes?

Older drivers who own cars built before stricter environmental regulations were introduced are likely to see the most dramatic increases in car tax. However, it’s important to note that the government has indicated certain exemptions and grace periods for specific groups.

Key Changes:

- Cars over 20 years old could see a significant increase in VED, especially if they fail to meet Euro 6 emissions standards.

- New road tax bands are being introduced, with stricter thresholds for emissions levels.

- Some tax exemptions may be available for drivers over 70 or those with disabilities.

Table: Estimated Increase in VED for Different Vehicle Types (Based on Emissions)

| Vehicle Type | Current Tax Band | Proposed Tax Band | Estimated Increase |

|---|---|---|---|

| Petrol (20+ Years) | Band F | Band J | £150 |

| Diesel (20+ Years) | Band G | Band L | £175 |

| Electric Vehicle | Band A | Band A | £0 |

| Hybrid (5-10 Years) | Band C | Band D | £25 |

What Should Older Drivers Consider Before the Changes Take Effect?

With the changes looming, older drivers should start considering their options. Here’s a look at some of the critical factors that could impact your decision-making:

1. Is It Time to Switch to a Greener Vehicle?

Given the rising tax rates for older, high-emission vehicles, now might be the ideal time to explore electric or hybrid alternatives. Not only could you save money on car tax, but you might also be eligible for other incentives and grants available to electric car buyers in the UK.

2. Can You Afford the Tax Increase?

For those who can’t afford to buy a new car, managing the higher VED rates may become a burden. Be sure to evaluate your finances and determine whether it’s better to hold onto your older vehicle or consider alternatives. Some strategies to mitigate the impact include:

- Switching to a more fuel-efficient car

- Buying a used hybrid or electric vehicle

How Will Older Drivers Be Impacted by the Upcoming Car Tax Changes?

As the UK moves forward with stricter emissions regulations, older drivers are among those who will be most affected by the upcoming car tax changes. It’s important to understand how these changes will impact your wallet and whether it’s time to rethink your vehicle choice. By making informed decisions now, you can minimize the financial strain and even take advantage of some attractive tax benefits.

What Are the Benefits of the Tax Changes for Older Drivers?

Though the changes may seem challenging, they also offer certain benefits. Let’s explore some of the possible benefits this could offer:

1. Encouraging Greener Choices

The government’s push for reduced emissions could lead to long-term environmental benefits, as well as a cleaner driving experience. Older drivers opting for electric or hybrid vehicles could contribute to lowering their carbon footprint.

2. Financial Incentives for Green Vehicles

As mentioned earlier, electric and hybrid cars will benefit from tax reductions. These financial incentives could significantly offset the cost of buying a greener car.

3. Simplification of the VED System

The new system promises to streamline how car tax is calculated, making it easier for drivers to understand what they’re paying and why.

How Will These Changes Affect the Future of Driving in the UK?

As older drivers start to adjust to the new tax bands, what will the future of UK driving look like? With stricter emissions regulations on the horizon, it’s clear that a larger portion of the population will eventually move towards electric vehicles.

1. A Greener Future

The goal is clear: fewer petrol and diesel vehicles, and more hybrid and electric vehicles on the road. Older drivers who transition to greener vehicles will play a role in shaping a more sustainable driving environment.

2. More Incentives for Electric Vehicle Adoption

Expect to see further incentives, such as lower charging costs or subsidies, making the transition easier for older drivers. Local authorities have implemented various measures to encourage the adoption of electric vehicles.

What Are the Challenges of Transitioning to Green Vehicles?

While electric cars offer many advantages, they come with their own set of challenges:

- Higher Initial Costs: Electric vehicles still tend to cost more upfront.

- Charging Infrastructure: Not every area has sufficient charging stations for electric vehicles, especially in rural locations.

Conclusion

The upcoming changes to car tax for older drivers are an important shift in how the UK is addressing the issue of carbon emissions and climate change. Though the higher tax rates for older, high-emission vehicles may seem burdensome, they also present an opportunity for older drivers to make a positive environmental impact by transitioning to greener cars. Now is the time to start planning for these changes to avoid surprises and explore potential savings. Whether you decide to upgrade to an electric vehicle or simply evaluate your current tax situation, understanding the impact of these changes is crucial for making informed decisions about your car ownership.

FAQs About the Upcoming Car Tax Changes for Older Drivers

Will my car tax increase if I drive a diesel vehicle older than 20 years?

Yes, diesel vehicles that are older than 20 years and emit higher CO2 levels will likely face a significant increase in car tax.

Can I apply for exemptions if I’m over 70?

Some exemptions might apply for elderly drivers, particularly if the vehicle is used infrequently. For additional eligibility information, it’s best to consult with your local authorities.

Will the VED system become simpler with the new changes?

Yes, the updated VED system is designed to be simpler and easier to understand, with clearer bands based on emissions.

Are there any grants for older drivers buying electric cars?

Yes, various government schemes and grants are available for older drivers who choose to transition to an electric vehicle. These can assist with both the cost of purchasing and setting up charging equipment.

When will the changes take effect?

The car tax changes for older vehicles are expected to take effect in the upcoming fiscal year, though exact dates may vary. Keep yourself informed by regularly checking the official government site.

Leave a Reply