Renewing your vehicle tax is a crucial responsibility for every driver in the UK. Not only is it a legal requirement, but staying on top of your vehicle tax helps you avoid costly fines and penalties that can escalate quickly. But what exactly must you have when renewing your vehicle tax? Whether you’re a new driver renewing for the first time or an experienced motorist, knowing the documents and details you need can make the process smooth and hassle-free.

In this guide, we’ll walk you through everything you need to know about renewing your vehicle tax in the UK, so you can stay compliant and keep your vehicle legally on the road.

Why Is Renewing Vehicle Tax Important?

Vehicle tax, also known as Vehicle Excise Duty (VED) or road tax, is an annual or biannual charge applied to vehicles used or parked on public roads in the UK. The funds collected are used to maintain road infrastructure, implement safety measures, and support environmental initiatives.

Renewing your vehicle tax on time is important because driving or parking a vehicle without valid tax is illegal. If caught without tax, you could face fixed penalties, court action, or even vehicle seizure.

What Must You Have When Renewing Vehicle Tax?

1. Your Vehicle Registration Certificate (V5C) or New Keeper’s Slip (V5C/2)

When renewing your vehicle tax, one of the most important things you must have is your vehicle’s registration details. These are found on your V5C (logbook), issued by the Driver and Vehicle Licensing Agency (DVLA). Specifically, you need:

- The 10-digit reference number from your V5C or the new keeper’s slip (V5C/2).

- This reference is essential when renewing online or by phone as it verifies your vehicle’s identity.

If you don’t have the V5C reference number, renewing your tax can be complicated. Contacting the DVLA to request a replacement may be necessary.

2. A Valid MOT Certificate (If Applicable)

Vehicles over three years old require a valid MOT certificate before you can renew your vehicle tax. The MOT test confirms that your vehicle meets UK safety and environmental standards.

- Your MOT must be valid at the start of your new tax period.

- If your MOT expires before your tax renewal date, you cannot legally renew your tax until you pass a new MOT.

- You can check your MOT status online through the official government website using your vehicle registration number.

3. Proof of Insurance

While you don’t need to provide proof of insurance when renewing your tax, it’s mandatory by law for all vehicles to be insured to be driven or parked on public roads. Driving uninsured can lead to severe penalties, including fines, licence points, or vehicle seizure.

4. Payment Method

You’ll need to pay your vehicle tax during renewal. The accepted payment methods depend on how you choose to renew:

- Online: Debit or credit card payments, or set up a Direct Debit to pay monthly, six-monthly, or annually.

- By Phone: Debit or credit card.

- At the Post Office: Cheque, postal order, or card payment (most Post Offices accept card payments).

Setting up a Direct Debit is highly recommended. It automatically renews your tax, reduces the risk of forgetting, and is convenient for budgeting your expenses.

5. Personal Identification (When Renewing at Post Office or In-Person)

If you choose to renew your vehicle tax at some Post Office branches or other physical locations, you may need to present identification such as:

- A valid UK driving licence or passport.

- Proof of your current address, especially if your V5C is outdated.

This ensures the accuracy of your details and prevents fraudulent tax renewals.

How to Renew Vehicle Tax: Your Options

There are three main ways to renew your vehicle tax in the UK:

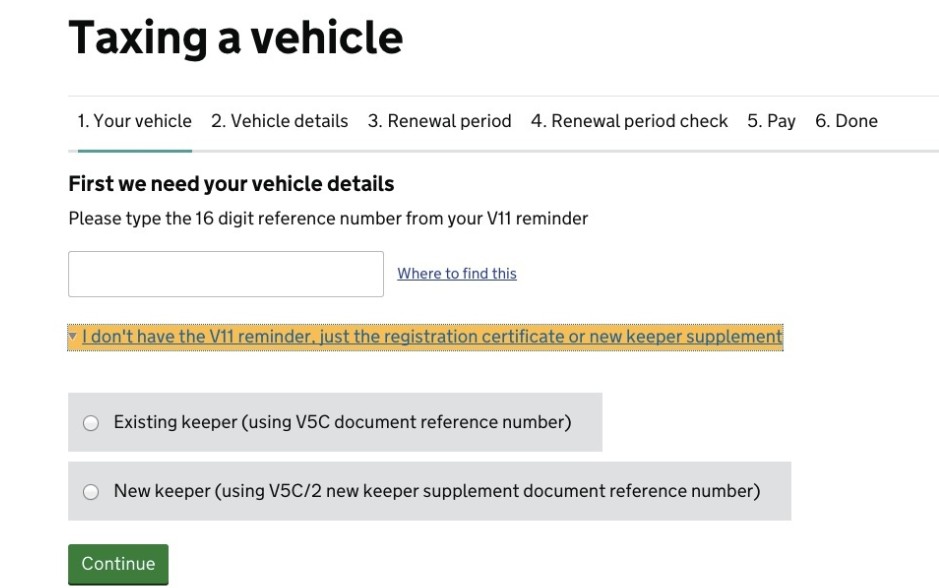

1. Online Renewal

The most popular and convenient method is renewing online via the official gov.uk website. You’ll need your 10-digit reference number from your V5C or renewal reminder, your vehicle registration number, and payment details.

- The online system allows you to choose the length of your tax period (1, 6, or 12 months).

- You can also set up a Direct Debit for automatic renewal.

- Renewal usually processes instantly, and you’ll receive confirmation via email.

2. Renewal by Phone

You can renew your vehicle tax by calling the DVLA Vehicle Tax service. Have your V5C reference number and payment card ready. This method is helpful if you’re unable to access the internet.

3. Renewal at a Post Office

You can still renew your vehicle tax at many Post Office branches by bringing your V11 reminder, V5C document, and payment method. Some branches accept card payments, while others prefer cheque or postal orders.

Helpful Tips for a Smooth Vehicle Tax Renewal

- Renew Early: Don’t wait until the last minute—renew before your current tax expires to avoid penalties.

- Keep Your Documents Safe: Your V5C and renewal reminder contain essential information needed for renewal.

- Update Your Details: Notify the DVLA if you change your address or vehicle ownership to keep your records current.

- Check Your Vehicle’s MOT Status: Renewing tax without a valid MOT (if required) is not possible.

- Consider Continuous Tax: Using Direct Debit means you don’t have to remember renewal dates.

What Happens If You Don’t Renew Your Vehicle Tax?

Failing to renew your vehicle tax has serious consequences:

- You risk a £80 fixed penalty that increases if unpaid.

- You may face court prosecution, which can result in higher fines.

- Your vehicle could be clamped, impounded, or even destroyed.

- You could receive points on your driving licence for repeated offences.

Avoid these troubles by keeping your vehicle tax up to date.

Conclusion

Understanding what you must have when renewing vehicle tax is the key to a hassle-free renewal process. Make sure you have your V5C reference number, a valid MOT certificate if required, and a reliable payment method. Whether renewing online, by phone, or in person, being prepared saves time and helps you stay compliant with UK law.

Renew your vehicle tax on time, keep your documents handy, and enjoy worry-free driving on UK roads.

Leave a Reply